Use AI Agents to cross-reference documents, apply business rules, and surface critical information for high-stakes human approvals (e.g., loan approvals).

Complex decisions, like approving an insurance claim or a loan, require reviewers to cross-reference dozens of documents, apply complex rule sets, and manually summarize findings—a process that is slow and inconsistent.

Reviewers must manually synthesize information across multiple documents.

Different experts apply rules differently, leading to bias.

Difficulty keeping up with ever-changing regulatory and business rules.

Hard to prove why a decision was made after the fact.

Delays in cognitive tasks frustrate customers and slow business.

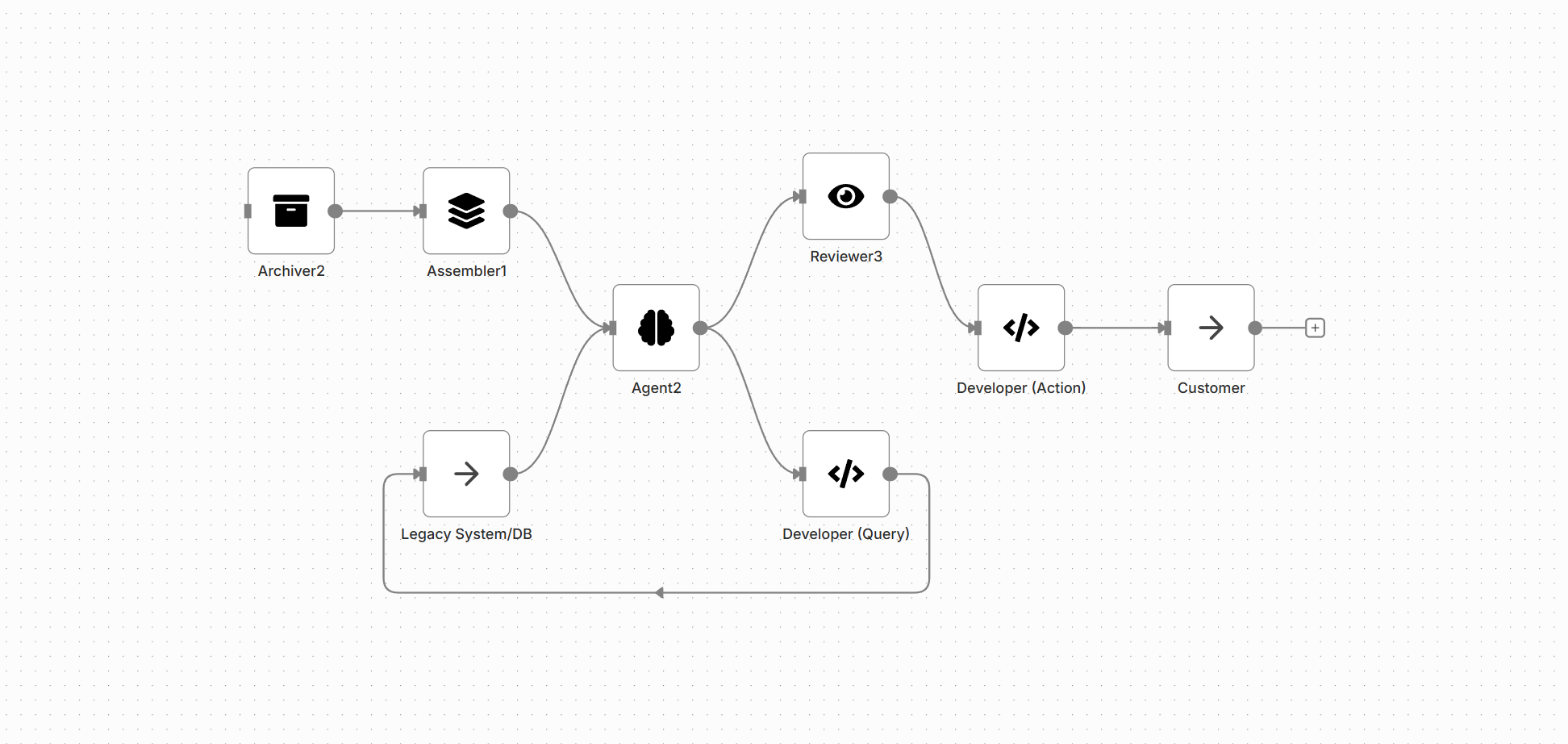

The Agent node is deployed to perform the cognitive heavy lifting. It ingests the fully processed case from the Assembler, uses its tools to query external systems (via Developer), and delivers a structured, document-grounded recommendation (e.g., "Recommend Approval, reason: Borrower debt-to-income is below 40% per Extractor data").

The Agent serves as a tireless digital analyst, providing the human expert with a complete, synthesized decision packet.

| Papyri Node | Role in Solution |

|---|---|

| Assembler | Gathers all relevant input documents (financials, IDs, applications) into one case. |

| Agent | The core decision engine. Compares extracted data across documents and applies business rules. |

| Developer | Acts as the tool interface, allowing the Agent to perform external lookups (e.g., credit check API). |

| Reviewer | The human expert who validates the Agent's decision summary and executes the final Approve/Deny action. |

| Composer | Generates the official communication (approval or rejection letter) based on the outcome. |

Reduces the time from application submission to final decision from days to hours.

Rules are applied identically across every case, reducing bias and inconsistency.

The Agent's reasoning is grounded in source documents, proving why the decision was made.

Experts focus on complex edge cases, delegating routine decisions to the Agent.

Any department that relies on experts to make rule-based judgments over complex data benefits from Agentic decision support.

The Agent is strictly configured to derive answers and recommendations only from the provided document set and verified external tool calls, preventing "hallucinations."

The Agent reliably executes actions in external systems using secure and traceable API calls.

The Agent generates a step-by-step audit trail for its reasoning (e.g., "Rule 4.1 applied because Extractor value X was < Y").

Includes rate-limiting and cost-control safeguards for external LLM calls, ensuring predictable operation and preventing budget overruns.

Designed to run parallel Agent tasks across thousands of cases simultaneously without queuing delays.

Provides detailed metrics on Agent response time, tool success rate, and confidence scores for each decision rendered.